The U.S. Export-Import Bank (EXIM) is expected to provide a $120 million loan to support the development of the Tanbreez rare earth mine in Greenland, an autonomous territory of Denmark. The site is considered one of the world’s largest deposits of rare earth elements.

According to Reuters and other foreign media reports on the 17th, U.S.-based mineral development firm Critical Metals has received a letter of interest (LOI) from EXIM Bank. The letter confirms that Critical Metals meets the preliminary requirements to apply for a 15-year loan worth $120 million.

Critical Metals, headquartered in New York, is partly owned by investment firm Cantor Fitzgerald, which is led by former Trump-era Commerce Secretary Howard Lutnick. Cantor Fitzgerald is currently the company’s third-largest shareholder.

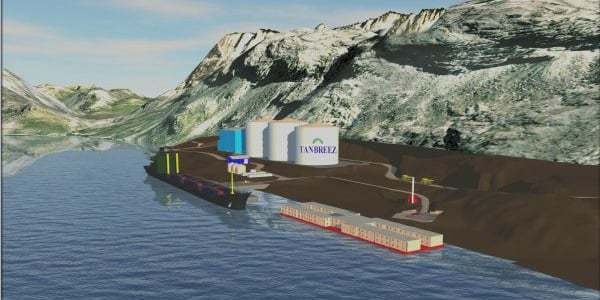

The Tanbreez mine is estimated to contain approximately 4.7 billion tonnes of rare earth ore. The total cost of the project is projected at around $290 million.

Critical Metals plans to begin operations as early as next year, initially producing 85,000 tonnes of rare earth concentrate annually. The company aims to increase output to 425,000 tonnes in the future.

“This financing package from EXIM is expected to bring significant value to our business and shareholders,” said Tony Sage, CEO of Critical Metals.

The company intends to ship the extracted concentrate to the United States for processing. If finalized, the loan will help secure facilities needed for refining and manufacturing.

If approved, this will be the first overseas mining investment made under the new Trump administration. After winning re-election in November last year, President Donald Trump reaffirmed his interest in bringing Greenland under U.S. control.

Greenland and the nearby Arctic region, long underdeveloped due to harsh conditions, are gaining economic and strategic importance as global warming accelerates glacial melt, making resources more accessible.

Rare earth elements, essential for advanced technology and military applications, have become a critical strategic resource. After China halted exports in April, countries have raced to secure alternative supplies amid escalating U.S.-China trade tensions.