Korea Zinc has made a strategic investment in the U.S. Nasdaq-listed deep-sea mining company The Metals Company (TMC), acquiring approximately 5% of its shares for over $85 million. The deal also grants Korea Zinc the right to purchase additional shares at a discounted price if TMC’s valuation increases. This move is part of Korea Zinc’s broader effort to secure a stable and competitive supply of critical raw materials amid intensifying global resource competition, while contributing to bilateral supply chain cooperation between Korea and the United States.

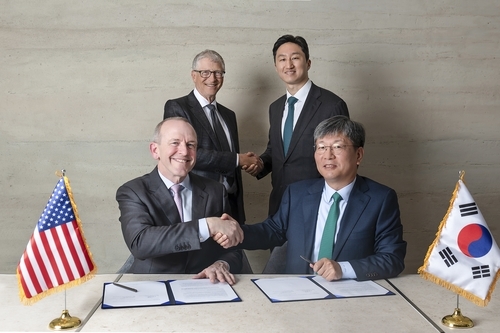

On June 16, Korea Zinc signed an agreement to acquire approximately 19.6 million shares of TMC, representing a 5% equity stake. Based on the closing price of $4.34 per share prior to the transaction, the investment totaled roughly $85 million. The agreement also includes warrants that allow Korea Zinc to purchase additional shares at a predetermined price, contingent on TMC’s future growth and market valuation.

According to TMC, the warrants allow Korea Zinc to acquire an additional 6.9 million shares at $7 per share over a three-year term—equal to 0.35 warrants per share from the initial acquisition. If TMC’s stock trades above $10 for 20 consecutive trading days, the warrants will be automatically exercised. This would enable Korea Zinc to acquire additional shares at a below-market price while maintaining its equity stake, even in the event of new share issuances.

Founded in 2011, TMC is a deep-sea mining company focused on extracting polymetallic nodules containing nickel, cobalt, copper, and manganese from the ocean floor. It holds mining rights in the Clarion-Clipperton Zone (CCZ) of the Eastern Pacific Ocean, off the coast of Mexico. The company’s goal is to secure and develop essential materials used in electric vehicles, renewable energy, and advanced industrial applications.

Korea Zinc expects to secure a stable supply of polymetallic nodules for its refining facilities and plans to enhance business collaboration through both domestic and international smelting operations.

Currently, Korea Zinc is constructing an integrated nickel smelter through its battery materials subsidiary KEMCO, with commercial operations slated for 2027. The facility will process raw materials supplied by TMC and export finished products to the U.S. market. Further discussions are underway to potentially build a nickel smelter within the United States as part of broader cooperation.

The partnership is expected to strengthen bilateral cooperation on critical minerals and resource security, while enhancing South Korea’s leverage in negotiations with the U.S. government. The move aligns with recent executive orders from the Trump administration aimed at countering China’s dominance in global mineral supply chains. TMC is expected to receive mining permits within the year, further contributing to supply chain diversification and independence.

Korea Zinc’s growing role in creating a China-free supply chain is also strategically significant. China currently dominates global nickel production, while Indonesia—the second-largest producer—is heavily backed by Chinese capital. Through this partnership, Korea Zinc and TMC aim to build a resilient, independent supply chain for key battery materials, free from Chinese influence.

“TMC is positioned to become one of the world’s most competitive producers of nickel and copper,” Korea Zinc said in a statement. “Our partnership with TMC will offer a unique and reliable nickel supply platform for U.S. businesses and consumers, and it will significantly strengthen Korea Zinc’s presence in the American market.”

Founded in 1974, Korea Zinc is a global leader in non-ferrous metal smelting, specializing in the production of zinc, lead, silver, and other key materials. Headquartered in South Korea, the company operates a world-class refining complex in Onsan and is actively expanding into battery materials and sustainable resource development.