Lotte Biologics is executing a carefully orchestrated U.S. market entry strategy through its Syracuse manufacturing facility acquisition, positioning itself as a serious contender in the global contract development and manufacturing organization (CDMO) landscape.

The Korean firm’s comprehensive preparation ranging from talent acquisition to technology transfer demonstrates a textbook approach to establishing Western operations in the highly competitive biopharma sector.

The company’s 225 million Syracuse investment including a 152 million facility purchase from Bristol Myers Squibb and $73 million in upgrades creates vital infrastructure for its North American ambitions.

Industry analysts highlight how Lotte is methodically checking all boxes for CDMO success: securing a strategic location near Cornell University and East Coast pharma hubs, implementing its proprietary SoluFlex Link ADC platform, and building a trans Pacific production network under CEO James Park’s leadership.

What sets Lotte’s approach apart is its simultaneous focus on both hard and soft infrastructure. While the physical plant transformation progresses toward June operations, the company is aggressively recruiting dozens of ADC manufacturing specialists and support staff a critical foundation for any successful CDMO operation.

Local economic development data shows Lotte rapidly becoming a major biotech employer in the Syracuse region, offering relocation packages and performance incentives to attract top talent from the Northeast’s concentrated life sciences corridor.

The Syracuse facility serves multiple strategic purposes in Lotte’s CDMO playbook. Beyond being an ADC production center, it provides a Western Hemisphere showcase for SoluFlex Link technology and creates a 24/7 operational cadence when combined with Korean facilities. This global footprint will be crucial for serving multinational pharma clients who demand around the clock development and manufacturing support.

“Building a CDMO presence requires more than just physical infrastructure it’s about establishing complete ecosystem capabilities,” noted a company spokesperson. With Phase 1 operations beginning next month and full ADC production launching in Q4, Lotte’s systematic preparation is being closely studied as a potential blueprint for Asian CDMOs seeking Western market entry. The company plans to debut its enhanced capabilities at upcoming industry events, with particular focus on demonstrating its end to end ADC solutions for potential partners.

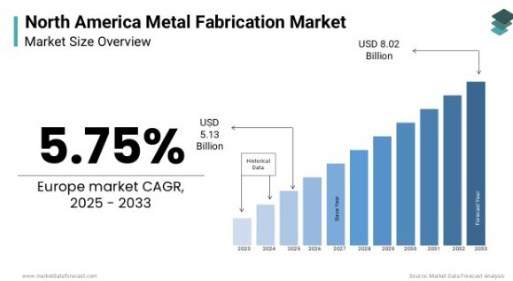

Market observers emphasize that Lotte’s measured, phase-based approach contrasts with the rushed expansions that have doomed other international CDMO ventures. By prioritizing talent acquisition, technology implementation, and operational integration before aggressively pursuing clients, Lotte appears to be building sustainable CDMO foundations rather than chasing short term gains a strategy that could pay dividends as the $8.4 billion ADC market continues its rapid growth trajectory.