The Tanbreez rare earth project in Greenland-an autonomous territory of Denmark-could be worth as much as $3 billion, according to a new assessment.

On April 2, U.S.-based mining company Critical Metals announced that a preliminary economic assessment (PEA) of the Tanbreez project estimates its potential value at up to $3 billion. The report places the after-tax net present value (NPV) between $2.1 billion and $2.7 billion, with an internal rate of return (IRR) of 180%.

NPV reflects the present value of future cash flows, discounted at a certain rate. A positive NPV signals that a project is financially viable, while a negative one suggests the opposite. IRR is the discount rate that makes the NPV zero-it measures the expected profitability of an investment.

“This PEA confirms the strong economic fundamentals of the Tanbreez project,” said Critical Metals CEO Tony Sage. “We plan to fast-track development of this rare earth site.”

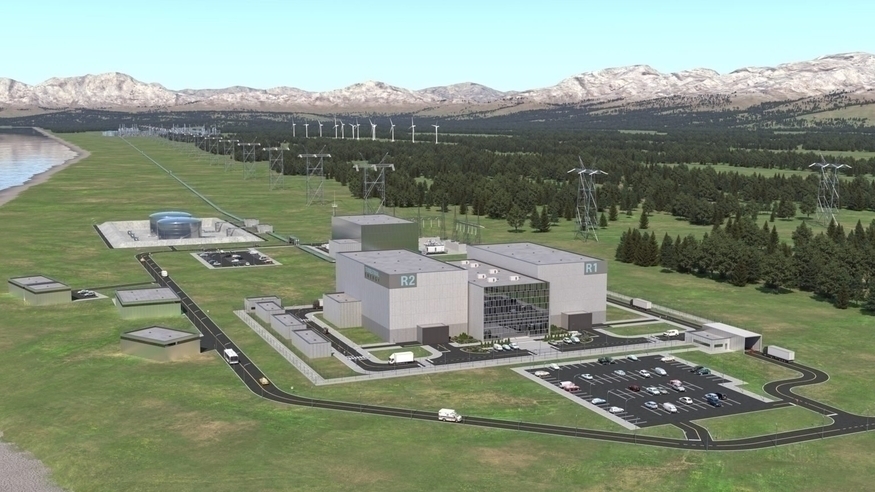

The Tanbreez project aims to extract 500,000 tons of eudialyte-bearing rare earth material annually by 2026. Critical Metals acquired the project stake last year from Greenland-based developer Tanbreez Mining.

Originally, Tanbreez Mining had planned to sell the mining rights to a Chinese firm. However, under pressure from the U.S. government, the stake was ultimately sold to Critical Metals instead. The deal involved $5 million in cash and $211 million worth of Critical Metals shares-significantly less than the offer from the Chinese company.

Critical Metals is headquartered in New York. One of its largest shareholders is Cantor Fitzgerald, a U.S. investment firm run by Howard Lutnick, who served as Commerce Secretary in Donald Trump’s second term.