A surge in new orders for Very Large Crude Carriers (VLCCs) is underway, driven by rising oil production and a growing need to replace aging tankers.

Major global shipping firms are now in talks with South Korean shipbuilders to place orders exceeding $2.2 billion, signaling continued momentum for South Korea’s shipbuilding industry.

Several media outlets report that global shipping companies are expected to place orders for at least 18 VLCCs worth a combined $2.25 billion in the coming months, citing TradeWinds, a Norway-based maritime industry outlet.

Among those preparing orders are Belgium’s CMB.Tech, Greece’s Tsakos Shipping & Trading, Taiwan’s Formosa Plastics Marine Corp, India’s Shipping Corporation of India (SCI), China’s Shandong Shipping, and South Korea’s Pan Ocean. Most are reportedly looking to order at least two vessels each.

Notably, this would mark the first VLCC order in a decade for Tsakos, Formosa, and SCI. Tsakos last placed an order in 2015 with HD Hyundai Heavy Industries, while Formosa hasn’t ordered VLCCs since 2006 and SCI since 2010. Tsakos is also said to be exploring LNG-powered VLCCs—currently the only carrier doing so.

The renewed interest stems from two factors: higher oil output and urgent demand for fleet replacement.

OPEC+ members decided in late 2023 to gradually boost production by 1.37 million barrels per day from April through July this year. But while supply is increasing, the number of vessels able to transport it is not—many are aging and near retirement.

According to Ralph Leszczynski, head analyst at Italian shipbroker Banchero Costa, “A significant wave of newbuild orders is needed to replace aging VLCCs.”

He added that a regulatory shift in the early 2000s mandating double hulls led to a construction boom, and now 18% of the global VLCC fleet is over 20 years old, with another 22% between 15 and 20 years.

Vessel age is critical for VLCCs, as older tankers are more prone to mechanical failures and environmental risk. Unlike bulk carriers that can operate 25 to 30 years, VLCCs face stricter viability standards.

A drop in newbuild prices is also fueling order activity. Clarkson Research estimates the current VLCC newbuild price at around $125 million, down 3% from a year ago.

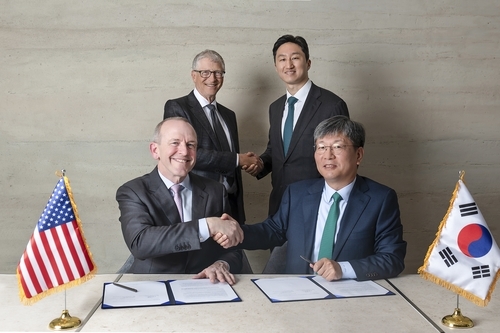

South Korean yards are expected to benefit significantly. Tsakos is reportedly in negotiations with HD Hyundai Heavy Industries, Samsung Heavy Industries, and Hanwha Ocean for two vessels.

SCI is also shopping for two VLCCs at roughly $120 million each and has approached builders in both Korea and China.

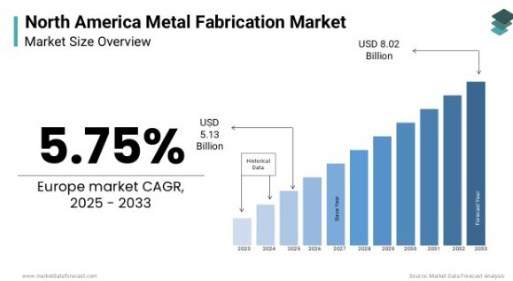

Clarkson Research reports that 103 VLCCs have been ordered so far this year, with South Korea securing 20, Japan 8, and the remainder going to Chinese shipyards.